Context:

Ethereum was strongly from the local summit at the end of last year. Investors still hope that the token will sooner or later find its excellent. Although it is above $ 2,000, ETH is still trying to take the final direction.

By observing whale activity, support and resistors, several indicators point to the market made in consolidation. Now the collapse as an increase for Ethereum should depend on the behavior of investors and the feeling of assets.

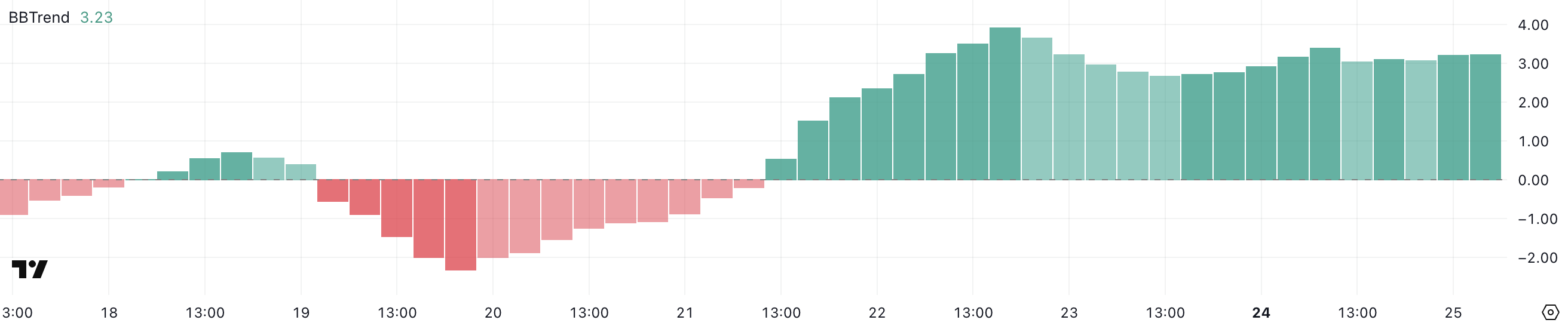

Bbtrend d’ethereum is positive

Bbtrend d’ethereum is currently at 3.23. He will stay in a positive territory for three days. The indicator recently culminated in 3.93 22 March and announced that this trend is until the short -term point of view.

This positive and lasting value suggests that Ethereum could return to momentum, but rather rather than active.

Recently, BBTREND has not reached conditions indicating a strong trend. In fact, the indicator was a content that shows a slight force without finding intensive momentum.

The Bbtrend indicator corresponds to the shortcut of the Bollinger Band trend. It is a technical indicator used to measure the strength of the course trends. It uses Bollinger Strips as a link to assess the course movements.

Values below 0.5 often point to a defined lack of trend and uncertainty about what happens. On the other hand, the value greater than 1 indicates a growing trendy power. If the value is greater than 3, as is currently the case, we benefit from a solid trend. In the best cases where the indicator exceeds 5, is directional movement, bull or bear, very strong. Meanwhile, Bbtrend d’ethereum is still far from 5.

Yet Bbtrend d’ethereum oscillates at 3.23. This suggests a certain directional belief. However, the trend is not as solid as when a value of 5 is reached. So even if the trend is formed on the ETH side, it still lacks momentum.

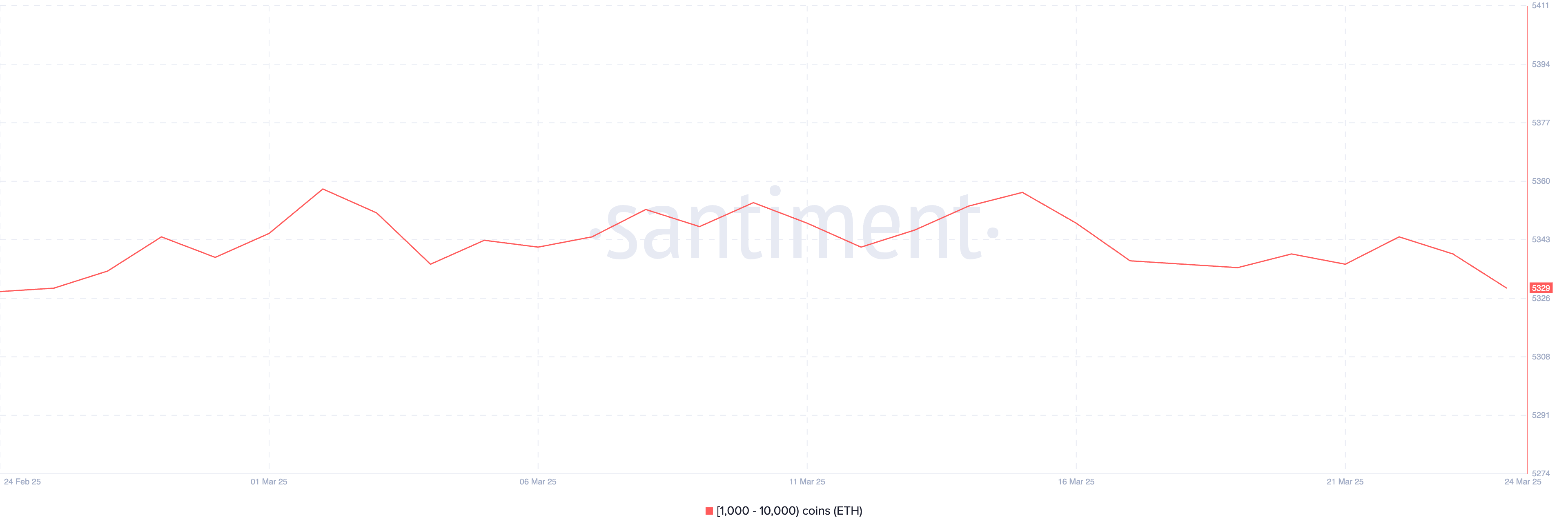

Less and less whales Ethereum

Whale Ethereum (portfolio holds between 1,000 and 10,000 ETH) fell to 5 329. Only three days ago there were 5 344 wallets.

This lightweight but noticed a decline, suggests a gradual reduction in the confidence of main investors to the token. At the same time, the number of whales is currently the lowest per month.

Although the change may seem minimal, whale behavior often affects the market crypto movements. This, especially if the trends of indicators show only a slight strength.

Whales are very important because in general, accumulation on their part is positive at asset prices. Yet it also forces private investors to strengthen their position. Conversely, a reduction in the number of whales may indicate profits from some investors or more cautious adoption.

Reducing the number of large portfolios may indicate increasing hesitation in large investors. As a result, this could reduce the Hussier of the Movement of ETH, at least in the short term. From now on, you will have to be patient and hope that investors will come back to stand up.

Will the token fall below $ 2,000?

Ema Lines Ethereum suggests that ETH cryptocurrency is still over $ 2,000 in the consolidation phase and fighting. Currently, the lack of Claire direction reflects a significant defense on the market. In addition, the Ethereum course is still negotiated to a narrow extent.

The UN has decreased if the Ethereum price is testing its key support to $ 1,938 without maintaining it, other objectives could be $ 1,867. Potentially assets could even drop to $ 1,759.

On the contrary, the Ethereum can find bull momentum in building a permanent trend of ascending, it could start to attack the main resistance for $ 2,320.

A successful breakthrough over this level could cause strong bull momentum. With dynamics in this way, the price target would be placed at $ 2,546 or even $ 2,855 per ETH.

Morality History: ETH wants to climb, but it doesn’t know how to do it!

Notification of irresponsibility

Notice of irresponsibility: In accordance with the Trust project Directives, this article for price analysis is intended only for information purposes and must not be considered financial or investment advice. Beincrypto undertakes to provide accurate and impartial information, but market conditions may change without prior notice. Always carry out your own research before making any financial decision and consult a professional.